Xero vs Odoo: Choosing the Right Accounting Solution for Australian SMEs

For Australian small and medium-sized enterprises (SMEs), selecting the right accounting software isn’t just about tracking numbers—it can determine efficiency, compliance, and growth potential. Two standout solutions in this space are Xero, a cloud-based accounting platform built with Australian compliance in mind, and Odoo, an open-source ERP system offering accounting as part of a broader business management suite.

Both tools are popular, but their approaches, features, and long-term value differ significantly. Let’s explore a practical comparison of Xero and Odoo to help SMEs make an informed choice.

A Quick Look at Xero and Odoo

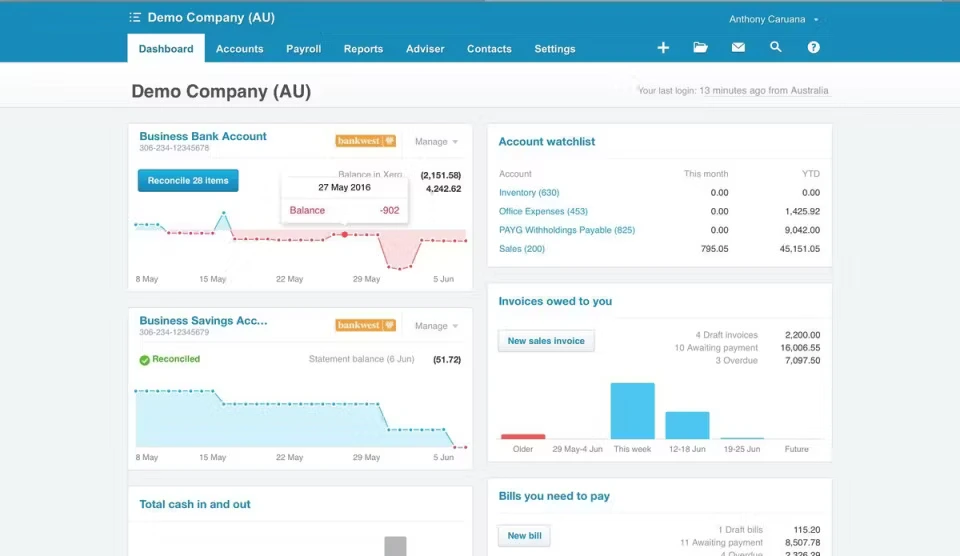

Xero is widely known for its simplicity and speed. It handles invoicing, bank feeds, payroll, GST, BAS lodgement, and reporting with minimal setup. Its user-friendly interface makes it ideal for business owners without extensive accounting knowledge.

Odoo, in contrast, is a full-fledged ERP system. Its Accounting module is just one component of a broader suite that includes CRM, inventory, HR, manufacturing, and more. While it requires more setup initially, Odoo’s modular structure allows for highly customised financial workflows and automation, supporting complex business processes as companies grow.

Comparing Key Features

| Feature | Xero | Odoo |

|---|---|---|

| Invoicing | Easy to use, compliant with Australian tax laws | Fully customisable with automated workflows |

| Bank Feeds | Real-time sync with Australian banks | Available via connectors or custom integration |

| Payroll | Built-in, ATO-compliant | Through Odoo Payroll or integrations |

| BAS/GST Reporting | Native support | Localisation via partners or modules |

| Custom Reports | Limited | Highly flexible and configurable |

| Multi-Company Support | Minimal | Robust and built-in |

| Scalability | Best for small businesses | Designed for growth and multi-department use |

| Integrations | Strong third-party ecosystem | Open-source API, extensive module library |

Localisation and Compliance

For Australian SMEs, compliance is non-negotiable. Xero offers out-of-the-box solutions for payroll, GST, BAS, and ATO reporting, making it convenient for startups and micro-businesses to get started quickly.

Odoo can match these capabilities but often requires configuration or partner-supported localisation. With the right setup, Odoo can handle:

- 📄 Australian GST and BAS reporting – manage taxes accurately.

- 🖊️ Single Touch Payroll (STP) integration – seamless payroll reporting to the ATO.

- ✅ ATO-compliant documentation – maintain records that meet regulatory standards.

This flexibility ensures that growing businesses can maintain compliance while expanding operations.

User Experience and Ease of Use

Xero excels in simplicity. Its intuitive interface is tailored for business owners, requiring little financial expertise.

Odoo, though initially more complex, becomes highly intuitive once users are trained. Its customisable dashboards, workflows, and automation make it ideal for businesses with evolving needs or complex operations.

Integration and Automation

Xero has a large marketplace with hundreds of integrations suitable for Australian SMEs—from POS systems to payroll add-ons.

Odoo’s open-source architecture allows businesses to integrate all aspects of operations—from sales and inventory to finance and HR—into one cohesive system. This reduces duplicate data entry, improves operational visibility, and streamlines workflows across departments.

Scalability and Long-Term Value

While Xero works exceptionally well for small businesses, it can struggle to meet the needs of expanding companies requiring advanced inventory, project management, or multi-company accounting.

Odoo is designed for scale. Its modular ERP system grows with your business, allowing you to add new functionalities without changing platforms, making it a long-term solution for SMEs planning growth.

Pricing Snapshot

Xero operates on tiered subscriptions. Initial costs are low, but adding more users or advanced features can become expensive.

Odoo offers flexible pricing: the community version is free, while the enterprise edition charges per app and user. This model can provide better ROI for growing businesses that need selective functionality without paying for unnecessary features.

When to Choose Xero

- 🟢 Small business friendly – ideal for basic accounting needs.

- 🟢 Ready-to-use – minimal setup required to start.

- 🟢 Compliance-focused – tax reporting and BAS handled out-of-the-box.

- 🟢 Simple operations – no need for advanced inventory, CRM, or manufacturing features.

When to Choose Odoo

- 🔵 Scalable – designed to grow with your business.

- 🔵 Integrated workflows – connect accounting with sales, inventory, HR, and more.

- 🔵 Custom workflows & advanced reporting – tailored to complex business needs.

- 🔵 Multi-company & multi-currency support – perfect for expanding SMEs.

- 🔵 Long-term ERP investment – a platform to manage all business processes under one system.

Final Thoughts

Both Xero and Odoo are excellent tools, but they serve different purposes. Xero is perfect for small businesses seeking simplicity and fast compliance, while Odoo offers greater flexibility, integration, and scalability—ideal for SMEs looking to grow and streamline all operations under one platform.

With the support of a qualified implementation partner, Odoo can match or exceed Xero’s accounting capabilities, providing not just a finance solution, but a full ERP backbone for long-term business success.

If you want, I can also generate a complementary blog image for this article that visually compares Xero and Odoo for Australian SMEs. It would make your blog more engaging and SEO-friendly. Do you want me to create that?